by Elaine M. Andersen*

Negotiating a plan of reorganization is the most consequential aspect of a Chapter 11 bankruptcy process for both debtors and creditors. The balance of power in that negotiation process is principally defined by the requirements for voting and plan approval which are laid out in section 1129(a) of the Bankruptcy Code. Courts are divided as to whether, in a case where a class of claims is proposed to be impaired under a joint, multidebtor plan, section 1129(a)(10) of the Bankruptcy Code re-quires acceptance from at least one impaired class of claims of any one debtor (the “per plan” approach) or, alternatively, acceptance from one impaired class of claims of each debtor (the “per debtor” approach). In this Contribution, Elaine Andersen (’21) argues that the “per plan” approach better comports with the text, context, and purpose of the section.

Bankruptcy culminates in either liquidation, in which the debtors’ assets are all sold to satisfy its debts, or reorganization, in which the debtor entity is restructured and continues doing business with an agreement among its creditors as to the eventual satisfaction of their claims. In a reorganization, the plan according to which the debtor is reorganized and the creditors’ claims are administered is of paramount concern. Accordingly, plan confirmation is perhaps the single most important phase of the reorganization process.

Usually, a Chapter 11 plan may be confirmed only if each class of impaired creditors consents.2 A class of claims is impaired if the claim holders’ rights are changed under the plan. If, for example, a claim will not be paid in full under the plan, it is impaired. Impairment triggers extra protections for the claimholder, like the aforementioned unanimous plan approval requirement. This requirement, however, is abridged in cramdown situations in which a plan is confirmed over the objections of one or more of the creditors.3 Section 1129 lists the requirements for approval of a cramdown plan and “contains a number of safeguards for secured creditors who could be negatively impacted by a debtor’s reorganization plan.”4 One such safeguard is section 1129(a)(10), which requires that at least one impaired class of claims has accepted the plan.5 This requirement importantly gives impaired creditors a seat at the negotiation table, but it should not be interpreted so as to give them a cudgel with which to hold the bankruptcy process hostage.

Section 1129(a)(10)’s safeguard should apply on a “per plan,” rather than “per debtor,” basis. The “per plan” approach, which has been adopted by the only circuit court to address this question as well as several federal bankruptcy courts, requires acceptance of the plan by one impaired class of claims under the plan.6 On the other hand, the “per debtor” approach, which has been adopted by the Delaware Bankruptcy Court,7 requires one accepting impaired class of claims for each debtor.8 Ultimately, this Contribution will argue that courts should adopt the “per plan” reading of section 1129(a)(10) because it more closely aligns with the text of the statute, fits comfortably with the rest of the section, and better advances the purposes of Chapter 11 reorganization.

A. The Plain Language of Section 1129(a)(10) Indicates a “Per Plan” Interpretation

The starting point for statutory interpretation must always be the text itself, and here the plain text of section 1129(a)(10) clearly supports the “per plan” approach. It is well-established that “the meaning of a statute must, in the first instance, be sought in the language in which the act is framed, and if that is plain . . . the sole function of the courts is to enforce it according to its terms.”9 The text of section 1129(a)(10) reads: “If a class of claims is impaired under the plan, at least one class of claims that is impaired under the plan has accepted the plan, determined without including any acceptance of the plan by any insider.”10 The text does not distinguish between the creditors of various debtors or between single-debtor and joint, multiple-debtor plans—indeed, it makes no reference to debtors at all. And yet, the “per debtor” approach reads into the statute the additional requirement of approval by an impaired class of claims of each debtor. Imputing this additional requirement and negating the plain statutory language strains principles of statutory interpretation and undermines the purposes of bankruptcy.

The language of section 1129(a)(10) is clear and unambiguous: once “at least one” impaired class has accepted the plan, section 1129(a)(10) is satisfied as to the entire plan.11 If Congress had intended this section to apply on a “per debtor” basis, it could have easily evinced this intent in the statutory language. The total absence of language referring to the debtor or debtors, distinguishing between single-debtor and multi-debtor plans, or otherwise indicating any situation in which the phrase “at least one” should be multiplied indicates that Congress did not intend for these considerations to be a part of the section 1129(a)(10) inquiry. As the Supreme Court has repeatedly stated, we must “presume that a legislature says in a statute what it means and means in a statute what it says there.”12 The text of section 1129(a)(10) unambiguously requires a “per plan” approach.

Courts applying the “per debtor” approach have argued that the rule of interpretation that “the singular includes the plural” changes the plain meaning of section 1129(a)(10), but this argument is unavailing.13 The first clause of section 1129(a)(10) uses the indefinite article “a” to refer to the impaired class or classes of claims which trigger the condition. In contrast, the second clause uses the definite number “one” to refer to the impaired class of claims that must consent to the plan to fulfill the condition. Because “one” cannot be made plural without self-contradiction, the rule that “the singular includes the plural” does not change the plain meaning of the section and does not support a “per debtor” interpretation. Regardless of whether “plan” is read in the singular or plural, the section requires “one class” of approving impaired claims. Because the text of section 1129(a)(10) calls for approval by “one class” of impaired claims, only one class’s approval is required.

B. The Context of the Bankruptcy Code and Canons of Statutory Interpretation Confirm a “Per Plan” Interpretation

Even if there were ambiguity in the language of section 1129(a)(10), the context of the bankruptcy code also supports a “per plan” approach to this section.14 Applying a “per plan” interpretation is the only way to give full effect to all terms in section 1129, avoid surplusage, and achieve a consistent reading of the section as a whole.

Reading a “per debtor” approach into section 1129(a)(10) would diminish the significance of the exemption from section 1129(a)(8) that is given in cramdown cases.15 Under section 1129(b), the court may cramdown a reorganization plan over objections, so long as all requirements of section 1129(a) other than 1129(a)(8) are met. Section 1129(a)(8) provides that “each class” of claims or interests must either accept or be unimpaired under the plan for the plan to be approved—in other words, each impaired class must approve. If a “per debtor” reading is given to section 1129(a)(10), then the 1129(a)(8) requirement is partially revived in the multi-debtor context. The “per debtor” reading re-introduces a class-by-class approach to approval and gives hold-outs disproportionate power, thus significantly reducing the utility of cramdown approval and section 1129(b).

If Congress had intended “per debtor” consideration, they would have included that in writing, as they did in other sections. While some subsections like 1129(a)(7) and (8) specifically refer to “each impaired class of claims” and “each class of claims,” subsection (a)(10) does not give the various classes this individualized treatment.16 Rather, 1129(a)(10) lumps together all classes impaired under the plan and demands acceptance by at least one. Congress knew how to invite individualized scrutiny, but it declined to do so as to section 1129(a)(10).

The court in In re Tribune Co. misinterpreted context to conclude that section 1129(a)(10) must apply on a “per debtor” basis because certain other subsections of 1129(a) apply on a “per debtor” basis.17 This argument fails for three independent reasons. First, it is not at all clear that the sections frequently cited for this proposition actually do apply on a “per debtor” basis. Second, even if the cited sections do apply on a “per debtor” basis, that does not create a conflict or contradiction within the statute when section 1129(a)(10) is interpreted “per plan.” Finally, even if the cited sections apply on a “per debtor” basis and create a general rule that the subsections of section 1129(a) should be read with a “per debtor” element, the more specific “per plan” rule announced by 1129(a)(10) should be understood to be an exception to that general rule.

As to the first point, the Tribune court contended that sections 1129(a)(1) and (a)(3) apply on a “per debtor” basis, and that neither section could be satisfied if one or more, but fewer than all, debtors complied with its requirements.18 This misstates the inquiry. Section (a)(3) requires that the plan be proposed in good faith—if one or multiple of the debtors demonstrates bad faith, that bad faith is imputed to the plan. So too with (a)(1)—if one or more of the debtors takes action inconsistent with the bankruptcy code, that is imputed to the plan, making the plan out of compliance with applicable law. In either case, the debtors are only relevant insofar as their actions affect the plan. Further, neither cited section contains any language explicitly indicating that it requires individualized application to each debtor.

Even assuming that sections 1129(a)(1) and (a)(3) apply on a “per debtor” basis, there is no reason that (a)(10) must function the same way. Though it is an important principle of statutory interpretation that statutes be read to be consistent with themselves, this principle reaches its breaking point when it is used to contradict the statutory text itself. Moreover, there is no reason “that all subsections must uniformly apply on a ‘per debtor’ basis, especially when the Bankruptcy Code phrases each subsection differently.”19 Because the various subsections of section 1129(a) are phrased differently, they should be interpreted differently. To supply a “per debtor” element to section 1129(a)(10) would require both adding words that are not present in the statute and ignoring the words that are present. Further, there is nothing contradictory about interpreting section 1129(a) such that some subsections apply “per debtor” and others apply “per plan”; such an interpretation would lead to no impossibilities or absurdities.

The court in Tribune asserted not only that sections 1129(a)(1) and (a)(3) apply on a “per debtor” basis, but that these and other subsections of 1129(a) establish a general rule that all of the section’s requirements ought to apply “per debtor.”20 Even if this interpretation is correct, it does not follow that this general “per debtor” rule must be imputed to section 1129(a)(10). On the contrary, if there is a general rule, then 1129(a)(10)’s specific and different rule must be understood as an exception to the general rule.21

C. The Purposes of Chapter 11 Reorganization Are Better Advanced by a “Per Plan” Interpretation than by a “Per Debtor” Interpretation

A “per debtor” approach to section 1129(a)(10) would contravene the purposes of Chapter 11 reorganization and create a perverse incentive for creditors holding impaired claims in multi-debtor bankruptcies to hold out and obstruct the reorganization process. The purposes of Chapter 11 are to revive the debtor’s business in a timely manner and to maximize the value and productivity of the bankruptcy estate.22 The “per debtor” approach not only prolongs the reorganization process and thus siphons value from the bankruptcy estate and retards the process of restarting the debtor’s business, but also encourages creation of plans that serve particular interests at the expense of these overall policy goals.

A ”per debtor” approach can create hold out problems, especially in circumstances where certain debtor entities have only one or a small number of creditors.23 If a “per debtor” reading is given to section 1129(a)(10), such a creditor could hold out for a reorganization plan that is beneficial to them, regardless of whether the plan would beneficially restructure the debtors’ businesses, preserve jobs, protect other creditors and investors, or maximize the value of the bankruptcy estate. Under the “per debtor” approach, such creditors are incentivized to use their leverage as a bludgeon and drag out the bankruptcy process, costing debtors, other creditors, and courts significantly more time and money. Hold outs like this could force debtors into liquidation, an outcome which is typically worse for all parties involved than reorganization. This is not a purely hypothetical problem—the problem of a class of one has occurred before and is likely to occur again.24 Additionally, there could be a class of zero problem. If one or multiple of the debtors in a jointly administered, multi-debtor bankruptcy had no voting impaired classes of claims, it is not clear that 1129(a)(10) could ever be satisfied under a “per debtor” approach.25

There is some disagreement as to the purpose of section 1129(a)(10). Some courts view section 1129(a)(10) as a mere technical requirement which does not create substantive rights for creditors.26 Under this view, the “per debtor” reading is not only inconsistent with the statute, it undermines its very purpose. A “per debtor” approach gives holdout creditors the right to unilaterally reject any reorganization plan they do not like; it not only creates a substantive right, but a very powerful one. Other courts argue that the purpose of section 1129(a)(10) is to ensure there are “some indicia of support” for a Chapter 11 plan.27 “Some indicia” is not a high bar. Under either view, the purpose of section 1129(a)(10) is not well served by manufacturing an additional requirement of heightened support. Even under the view that section 1129(a)(10) is more than a technical requirement, there is no reason that a “per debtor” approach is needed in order to ensure that the plan has “some indicia” of creditor support.

The Bankruptcy Code is intended to encourage consensual resolution of claims through the plan negotiation process.28 Chapter 11 in particular is designed to encourage the timely and efficient reorganization of distressed businesses so as to preserve jobs and economic value.29 None of these purposes are advanced by applying an artificially heightened “per debtor” standard.

Not only is a “per plan” approach clearly indicated by the statutory text and context, but also it is urged by common sense and the purposes of Chapter 11. For all those reasons, the “per plan” approach should be preferred to the “per debtor” approach.

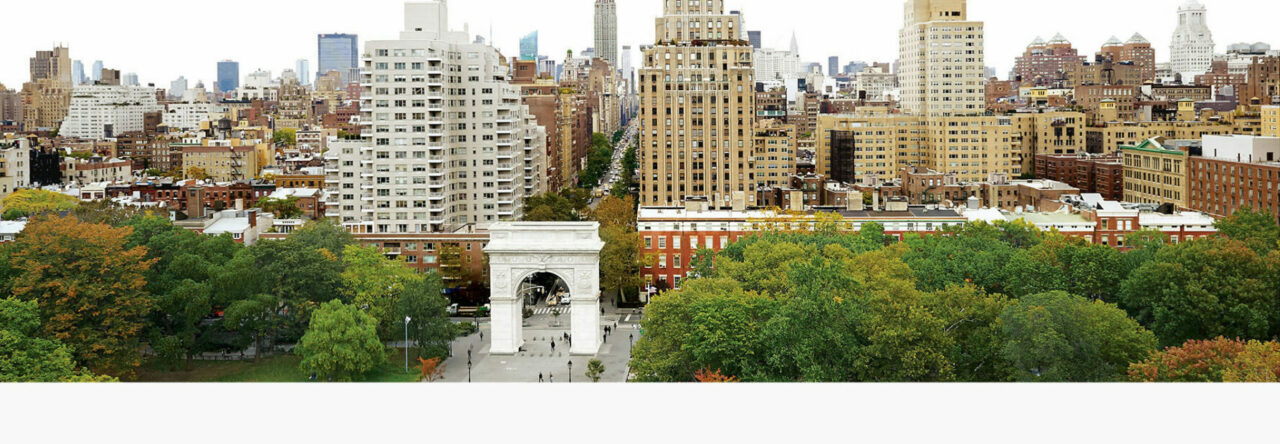

* Elaine Andersen is a J.D. Candidate (2021) at New York University School of Law. This piece is a commentary on the 2020 Problem at the Duberstein Bankruptcy Moot Court Competition held in Queens, New York. The views expressed in this article do not necessarily represent the views of the author on this point of law. Rather, this article is a distillation of one side of an argument assigned to the team the author represented at the Duberstein Bankruptcy Moot Court Competition.

2. 11 U.S.C. § 1129(a)(8).

3. See 11 U.S.C. § 1129(b)(1).

4. U.S. Bank N.A. v. Vill. at Lakeridge, LLC (In re Vill. at Lakeridge, LLC), 814 F.3d 993, 1000 (9th Cir. 2016).

5. See 11 U.S.C. § 1129(a)(10).

6. See JPMCC 2007-C1 Grasslawn Lodging, LLC v. Transwest Resort Props. (In re Transwest Resort Props.), 881 F.3d 724, 729–30 (9th Cir. 2018) (assessing and rejecting “per debtor” approach and applying “per plan” approach); In re Enron Corp., No. 01-16034, 2004 Bankr. LEXIS 2549, at *234–36 (Bankr. S.D.N.Y. July 15, 2004) (same); In re SGPA, Inc., No. 1-01-02609, 2001 Bankr. LEXIS 2291, at *12–22 (Bankr. M.D. Pa. Sept. 28, 2001) (same); see also In re Station Casinos, Inc., Nos. BK-09-52477, BK 09-52470, BK 09-52487, 10-50381, 2010 WL 11492265, at *23 (Bankr. D. Nev. Aug. 27, 2010) (citing SGPA and Enron and applying “per plan” approach); JPMorgan Chase Bank, N.A. v. Charter Commc’ns Operating, LLC (In re Charter Commc’ns), 419 B.R. 221, 264–66 (Bankr. S.D.N.Y. 2009) (same).

7. See In re Tribune Co., 464 B.R. 126, 182–83 (Bankr. D. Del. 2011) (applying “per debtor” approach); see also In re Woodbridge Grp. of Cos., 592 B.R. 761, 778–79 (Bankr. D. Del. 2018) (citing Tribune and applying “per debtor” approach to case involving substantively consolidated parties); In re JER/Jameson Mezz Borrower II, LLC, 461 B.R. 293, 301–02 (Bankr. D. Del. 2011) (citing and applying Tribune).

8. One federal bankruptcy court has considered without deciding the issue. In re ADPT DFW Holdings, LLC, 574 B.R. 87, 104–07 (Bankr. N.D. Tex. 2017) (applying “per plan” approach to substantively consolidated debtors, making no decision as to which approach would be appropriate for jointly administered, multi-debtor plans).

9. Caminetti v. United States, 242 U.S. 470, 485 (1917); see also United States v. Ron Pair Enters., 489 U.S. 235, 241–42 (1989) (announcing same principle in Chapter 11 bankruptcy context).

10. 11 U.S.C. § 1129(a)(10).

11. See Transwest, 881 F.3d at 729.

12. Conn. Nat’l Bank v. Germain, 503 U.S. 249, 253–54 (1992).

13. 11 U.S.C. § 102(7) (singular includes the plural rule of interpretation); see Tribune, 464 B.R. at 182 (applying rule to section 1129(a)(10) so as to make “plan” plural).

14. See generally FDA v. Brown & Williamson Tobacco Corp., 529 U.S. 120, 133 (2000) (“[T]he words of a statute must be read in their context and with a view to their place in the overall statutory scheme.” (citation omitted)), superseded by statute on other grounds.

15. See 11 U.S.C. § 1129(b)(1) (“[I]f all of the applicable requirements of subsection (a) of this section other than paragraph (8) are met with respect to a plan, the court, on request of the proponent of the plan, shall confirm the plan notwithstanding the requirements of such paragraph if the plan does not discriminate unfairly, and is fair and equitable, with respect to each class of claims or interests that is impaired under, and has not accepted, the plan.”).

16. 11 U.S.C. § 1129(a)(7), (8).

17. 464 B.R. at 182–83.

18. See 11 U.S.C. § 1129(a)(1), (3); Tribune, 464 B.R. at 183.

19. Transwest, 881 F.3d at 730.

20. 464 B.R. at 183.

21. See RadLAX Getaway Hotel, LLC v. Amalgamated Bank, 566 US 639, 645 (2012) (applying rule of statutory construction that “the specific provision is construed as an exception to the general one” in Chapter 11 bankruptcy context).

22. See, e.g., Toibb v. Radloff, 501 U.S. 157, 163–64 (1991) (stating that Chapter 11 reorganization serves both the purposes of “permitting business debtors to reorganize and restructure their debts in order to revive the debtors’ businesses and thereby preserve jobs and protect investors” and of “maximizing the value of the bankruptcy estate”); H.R. Rep. No. 95-595, at 5 (1978), as reprinted in 1978 U.S.C.C.A.N. 5963, 6179 (“The purpose of a business reorganization case, unlike a liquidation case, is to restructure a business’s finances so that it may continue to operate, provide its employees with jobs, pay its creditors, and produce a return for its stockholders.”).

23. See Young v. Higbee Co., 324 U.S. 204, 211 (1945) (stating that a stakeholder should not be permitted to “obstruct a fair and feasible reorganization in the hope that someone would pay them more”).

24. See In re JER/Jameson Mezz Borrower II, LLC, 461 B.R. 293, 302 (Bankr. D. Del. 2011) (“Because Colony is Mezz II’s only creditor, confirmation of a plan to which they do not consent is not possible [under a ‘per debtor’ approach].”).

25. See In re Station Casinos, Inc., Nos. BK-09-52477, BK 09-52470, BK 09-52487, 10-50381, 2010 WL 11492265, at *23 (Bankr. D. Nev. Aug. 27, 2010) (approving reorganization plan under “per plan” approach in case where “several of the Debtors had no Voting Classes”).

26. See In re Rhead, 179 B.R. 169, 177 (Bankr. D. Ariz. 1994) (“Section 1129(a)(10) is a technical requirement for confirmation. It is an obligation for the proponent to fulfill; it is not a substantive right of objecting creditors.”).

27. In re Combustion Eng’g, Inc., 391 F.3d 190, 243–44 (3d Cir. 2004); P. Murphy, Creditors’ Rights in Bankruptcy, § 16.11, at 16–20 (1980) (“The only conceivable purpose of Section 1129(a)(10) is to require some indicia of creditor support [for the reorganization plan].”).

28. See, e.g., Windsor on the River Assocs. v. Balcor Real Estate Fin. (In re Windsor on the River Assocs.), 7 F.3d 127, 131 (8th Cir. 1993) (“Chapter 11 is designed to promote consensual reorganization plans.”); In re AVBI, Inc., 143 B.R. 738, 739–40 (Bankr. C.D. Cal. 1992) (“Chapter 11 is designed to foster consensual plans of reorganization.”).

29. See, e.g., Toibb v. Radloff, 501 U.S. 157, 163–64 (1991) (explaining the purposes of Chapter 11).