by Alec Soghomonian*

The First Amendment’s Religion Clauses provide that “Congress shall make no law respecting the establishment of religion, or prohibiting the free exercise thereof . . . .” The Religion Clauses clearly prohibit both the Federal and state governments from establishing an official state religion or hindering religious practice to such an extent that it results in a constitutional infringement. However, the Supreme Court has long acknowledged that absent those two clear commands “there is room for play in the joints” when addressing the constitutionality of government action that implicates religious belief. Does a tax benefit that provides a financial benefit to a limited class of religious employees and their employers violate the Establishment Clause? In this Contribution, Alec Soghomonian (‘22) argues that the Parsonage Exemption, found in 26 U.S.C. § 107(2) of the United States tax code, unlawfully provides a benefit to religious employees and employers because it does not extend to similarly situated non-religious institutions.

Religious favoritism rears its head in many different forms. While some instances can be blunt and obvious, more subtle and inconspicuous variations play a large role in the abrogation of the separation between church and state. One such subtle form of religious favoritism can be found in the United States Tax Code. The parsonage exemption is part of a broader statutory scheme in the Internal Revenue Code known as the convenience of the employer doctrine.1 The convenience of the employer doctrine excludes “housing provided to employees for the convenience of their employer” from the income of employees.2 The modern codification of the convenience of the employer doctrine is 26 U.S.C. § 119(a)(2), which exempts meals and lodgings provided to employees who meet the following criteria: “the meal or lodging is furnished (1) by an employer to an employee, (2) in kind (as opposed to in cash), (3) on the business premises of the employer, (4) for the convenience of the employer, and (5) as a condition of employment.”3

Section 119 is a general, broadly applicable statute: so long as an employee can meet the five pre-conditions set out in the regulation, they will be entitled to the tax deduction. Importantly, as the regulation notes, only those employees who are provided housing in kind, not those who are provided cash allowances for housing, are allowed to claim the deduction.4 However, this limitation does not apply to “ministers of the gospel” and the religious institutions that employ them. Indeed, 26 U.S.C. § 107(2) explicitly allows for ministers of the gospel—and only ministers of the gospel—to deduct “the rental allowance paid to him as part of his compensation, to the extent used by him to rent or provide a home.”5 This patent favoritism of religion over non-religion violates the Establishment Clause of the First Amendment.

*****

Understanding the history and context of the Parsonage Exemption is necessary to understand the constitutional arguments made both in its favor and disfavor. Prior to the enactment of the Parsonage Exemption, the Treasury Department only applied the convenience of the employer doctrine to secular employees and, in 1921, promulgated a rule that it did not apply to ministers.6 Congress reacted to the Treasury’s decision by passing the Revenue Act of 1921, which provided for the exclusion of “the rental value of a dwelling house and appurtenances thereof furnished to a minister of the gospel as part of his compensation.”7 Section 213(b)(11) was the precursor to section 107(1), which merely extends the same in-kind housing deductions that are available to non-religious, secular employees to ministers of the gospel.

In 1954, Congress enacted § 107(2), which extended the cash housing deduction benefit solely to religious organizations and their employees.8 Although constitutionally suspect from the start, the Parsonage Exemption remained unchallenged until 2002. In Warren v. Commissioner of Internal Revenue,9 a case regarding the taxes owed by a minister, the Ninth Circuit questioned the constitutionality of the Parsonage Exemption at oral argument and subsequently requested briefing on the matter.10 However, Congress quickly passed the Clergy Housing Allowance Clarification Act of 200211 with the express purpose of rendering the Warren case moot and saving ministers of the gospel from incurring the steep tax liability.12 According to the Congressional record, had the Ninth Circuit ruled that the Parsonage Exemption was unconstitutional, ministers of the gospel “would be faced with a tax increase . . . of roughly 2.3 billion [dollars] in the next few years.”13

Although the Ninth Circuit failed to reach the merits on the Parsonage Exemption’s constitutionality, the Seventh Circuit upheld the provision in Gaylor v. Mnuchin.14 Despite this, the Parsonage Exemption’s constitutionally remains unclear and is ripe for legal challenge in other federal circuits. The Parsonage Exemption should be held unconstitutional for three reasons, each one of which is sufficient on its own.

First, the Parsonage Exemption violates the Supreme Court’s religious tax cases, namely Walz v. Tax Commission of City of New York15 and Texas Monthly, Inc. v. Bullock.16 Walz involved a New York City tax exemption that applied to a wide range of religious properties, but also secular institutions such as hospitals, non-profits, and libraries.17 The Supreme Court held that this widely applicable tax exemption was constitutional because of its broad applicability.18 It did not favor religion, but rather, incorporated religious organizations into a tax exemption scheme that applied to similarly situated secular organizations. The tax exemption in Texas Monthly, however, did not extend to similarly situated secular publications. Texas had passed a tax exemption that applied solely to religious magazine publications.19 The Court held that the application of the exemption solely to religious publications violated the Establishment Clause.20 Indeed, Justice Brennan’s plurality opinion explicitly stated that as long as a tax benefit “is conferred upon a wide array of nonsectarian groups as well as religious organizations,” the tax scheme is in compliance with the commands of the Establishment Clause.21

The rule from Walz and Texas Monthly is clear: tax exemptions that do not apply to both religious organizations and similarly situated non-religious entities violate the Establishment Clause. The Parsonage Exemption violates this fundamental rule. It is a tax exemption that applies to ministers of the gospel and only to ministers of the gospel. Its failure to extend to similarly situated, non-religious organizations and employees is a blatant violation of clear Establishment Clause jurisprudence.

The Gaylor court reasoned that because the Parsonage Exemption was part of a broader statutory scheme, it was more analogous to the property tax exemption in Walz than the religious publication exemption in Texas Monthly.22 The Court cited the doctrine of in pari materia, which requires courts to interpret similar statutes in light of each other because they have a common purpose for comparable events or items.23

However, the Gaylor court’s reasoning misses the mark for two reasons. First, it fundamentally misreads Walz. The property tax exemption in Walz was broadly applicable in and of itself. The Parsonage Exemption, in stark contrast, applies only to ministers of the gospel, not to similarly situated non-religious employees. The question is not whether the broader statutory scheme is constitutional, but rather whether a specific tax provision within a broader scheme is constitutional. Second, in pari materia is a doctrine about statutory interpretation, i.e., what the words of a statute mean, and has no particular relevance to determining whether or not a specific statutory provision is constitutional. Imbuing the Parsonage Exemption with a gloss of legality through the broader statutory scheme does not address whether or not the Parsonage Exemption in and of itself is constitutional.

*****

Moreover, the Parsonage Exemption fails to satisfy the requirements of the test set forth in Lemon v. Kurtzman24 (hereinafter the “Lemon test”). In its landmark decision, the Lemon court announced a tripartite test to determine whether a statute is constitutional under the Establishment Clause. Under the Lemon test, the governmental authority has the burden of showing that the statute “[1] ha[s] a secular legislative purpose; [2] its principal or primary effect must be one that neither advances nor inhibits religion; [3] finally, the statute must not foster an excessive government entanglement with religion.”25 Because the primary effect of the Parsonage Exemption is the advancement of religion, it is unconstitutional.

The first prong of the Lemon test requires that the government action have a “secular legislative purpose.”26 The Supreme Court has long stated that laws are presumed to have a secular legislative purpose, and it is up to challengers to show that the government’s proffered purpose is “a sham.”27 This is admittedly a heavy burden for legal challengers, because government officials typically do not announce their unlawful motives for enacting a law. However, the use of legislative history has been used by challengers to show the non-secular purposes behind a law.28 In Edwards v. Aguillard, for instance, there was clear and unequivocal evidence in the legislative record that a Louisiana education law that banned evolution in school was motivated by non-secular purposes.29 The legislative history of the Parsonage Exemption highlights its religious motivation. Enacted during the early days of the Cold War, the legislation’s sponsor, Representative Peter Mack stated:

Certainly, in these times when we are being threatened by a godless and anti-religious world movement we should correct this discrimination against certain ministers of the gospel who are carrying on such a courageous fight against this foe. Certainly this is not too much to do for these people who are caring for our spiritual welfare.30

However, courts are still likely to side with the government on the first prong for three reasons. First, Supreme Court precedent has made it clear that in order to have a non-secular purpose, the law must be “wholly” devoid of any religious motivation.31 This allows the government to pass laws that coincidentally make it easier for religious institutions to act as religious institutions, so long as the primary motivation behind the law’s enactment is not the unlawful benefit of religion.32 Second, the federal judiciary has grown increasingly wary about the use of legislative history, at least in the statutory interpretation context.33 Moreover, given the presumption of legality, courts will often defer to the government’s articulated reason, especially when the legislative record is thin.34

Challengers will have a better chance of winning on the second prong of the Lemon test, which states that the law’s primary effect “must be one that neither advances nor inhibits religion.”35 The Parsonage Exemption, which allows religious organizations to save billions of dollars in tax revenue and allows them to pay their employees less than a similarly situated secular entity,36 clearly violates the second prong of Lemon. The Parsonage Exemption’s unique tax break provided solely to ministers of the gospel does not simply make it easier for religious organizations to act as religious organizations, but rather actively provides churches with large financial and economic benefits that are not available to non-religious entities.37

The government may defend the Parsonage Exemption by citing Corporation of Presiding Bishop of Church of Jesus Christ of Latter-Day Saints v. Amos,38 for the proposition that the exemption is a necessary accommodation for religious belief because, without it, religious exercise would be stifled. However, this reading of the Amos opinion is too broad. The Court in Amos was rightfully concerned about the free exercise concerns that would arise if religious organizations were held civilly liable for violating Title VII of the Civil Rights Act.39 Indeed, had the Court decided differently, many religious groups, like the Roman Catholic Church would be forced to hire women priests, which goes against their core religious beliefs.

But no free exercise concerns would be generated if religious organizations’ ministers of the gospel were treated equally to similarly situated secular organizations and their employees. Instead, the Parsonage Exemption unabashedly fosters religious belief. Religious organizations are able to save billions of dollars that would typically be taxed by the government.40 These cost saving mechanisms allow religious organizations to pay their employees less than non-religious entities, because secular employees need to make up for the lost income with higher salaries. By avoiding these costs, the Parsonage Exemption primary effect is the advancement of religion, thus violating the second prong of the Lemon test.

Lastly, the Lemon test requires there be only minimal entanglement between the government and religion.41 Entanglement is a question of both “kind and degree”: the Constitution does not prohibit all entanglement between government and religion, only excessive entanglement.42 Importantly, excessive entanglement occurs when the government looks deeply into a religious organization’s affairs.43 The Parsonage Exemption does create some entanglement between government and religion. It requires the Internal Revenue Service (“IRS”) and reviewing courts to determine whether a given religious employee is a “minister of the gospel.” This highly fact-intensive inquiry includes determining, amongst other things, what the individual was hired to do and the actual work they performed.44 Indeed, the government having to look deeply into an organization’s religious affairs, like determining which employee qualifies as a minister of the gospel and which one does not, is the very concern that troubled the Supreme Court in Lemon.45

However, recent Supreme Court precedent makes it likely that courts will find that the Parsonage Exemption does not lead to excessive entanglement. Hosanna-Tabor Evangelical Lutheran Church and School v. EEOC46 was a case regarding the ministerial exception in the employment context. Although ostensibly not a taxation-related decision, the fact-intensive inquiry the Supreme Court conducted in Hosanna-Tabor looked to the same factors the IRS and courts use to determine whether an individual qualifies as a minister of the gospel.47 Due to this tacit approval of a similar inquiry, it is likely that the Parsonage Exemption satisfies the Lemon test’s third prong. But Lemon is an element test, and since the Parsonage Exemption’s primary effect is the advancement of religious belief in violation of the Lemon test’s second prong, the provision is unconstitutional.

*****

The Lemon test has been heavily criticized by the Supreme Court in large part due to its perceived animus towards religious belief.48 Due to this perceived animus, the Supreme Court has created a new Establishment Clause test known as the “Historical Practices Test.” Applied mostly in Religious Symbolism cases, the Historical Practices Test is a two-part inquiry. First, a Court asks whether the practice “was accepted by the Framers and has withstood the critical scrutiny of time and political change.”49 Next, the Court must determine whether the practice promotes an independent secular value.50 For instance, when upholding the sectarian legislative prayer at issue in Town of Greece, the Court noted that legislative prayer “invites lawmakers to reflect upon shared ideals and common ends before they embark on the fractious business of governing.”51

Although the Historical Practices jurisprudence is limited, the Parsonage Exemption cannot survive its scrutiny. As a threshold matter, it is not entirely clear whether the Parsonage Exemption should be subjected to the Historical Practices Test, since the concerns many justices have about the use of Lemon in the religious symbol context simply do not apply in a case concerning taxation exemptions.52 However, even if the Historical Practices Test were to apply, the Parsonage Exemption fails to meet the test’s second requirement of promoting an independent secular value, since its principal benefit and purpose is the advancement of religious belief. A tax exemption that applies solely to ministers of the gospel and not to any other members of the secular, non-religious working force does not promote or foster an independent secular value.

*****

The Parsonage Exemption is a relatively unknown provision of the United States Tax Code. However, it brings to light important constitutional questions that must be addressed by the courts. The erosion of the First Amendment’s Establishment Clause and the vital safeguards it protects necessitate challenging the constitutionality of the Parsonage Exemption. Whether as a matter of precedent, the Lemon test, or the Historical Practices Test, the Parsonage Exemption should be deemed unconstitutional. Anything less risks abrogating a fundamental constitutional provision that upholds our nation’s guarantee of a religiously neutral government.

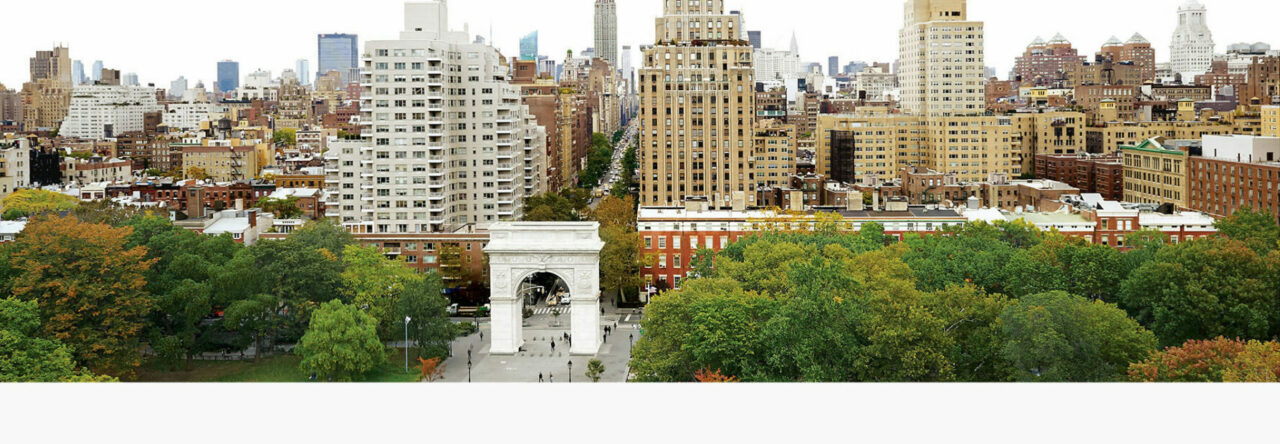

*Alec Soghomonian is a J.D. Candidate (2022) at New York University School of Law. This piece is a commentary on the problem presented at the 2021 Touro Law & Religion Moot Court Competition at Touro School of Law. The question presented asked whether the Parsonage Exemption, 26 U.S.C. § 107(2), violates the Establishment Clause of the First Amendment. This Contribution presents a distillation of the opposing side of the argument argued by the author at the competition and reflects his understanding and belief on this point of law.

1. See generally 26 U.S.C. § 119(a).

2. Gaylor v. Mnuchin, 919 F.3d 420, 423 (7th Cir. 2019).

3. Gaylor, 919 F.3d at 428 (emphasis added).

4. Id.

5. 26 U.S.C. § 107(2).

6. Gaylor, 919 F.3d at 424.

7. Pub. L. No. 98, § 213(b)(11), 42 Stat. 227, 239.

8. Internal Revenue Code of 1954, Pub. L. No. 83-1987, 68A Stat. 32.

9. 114 T.C. 343 (2000).

10. Erwin Chemerinsky, The Parsonage Exemption Violates the Establishment Clause and Should be Declared Unconstitutional, 24 Whittier L. Rev. 707, 707–08 (2003).

11. Pub. L. No. 107-181, §2(b)(2), 116 Stat. 583 (2002).

12. 148 Cong. Rec. H1301 (daily ed. Apr. 16, 2002).

13. Id. at H1301.

14. Gaylor, 919 F.3d at 436–37.

15. 397 U.S. 664 (1970).

16. 489 U.S. 1 (1989) (plurality opinion).

17. Walz, 397 U.S. at 673.

18. Id. at 675–76.

19. Texas Monthly, 489 U.S. at 16 (plurality opinion).

20. Id. at 5.

21. Id. at 14.

22. Gaylor, 919 F.3d at 429.

23. See Antonin Scalia & Bryan A. Garner, Reading Law 252 (2012) (“Several acts in pari materia, and relating to the same subject, are to be taken together, and compared in construction of them, because they are considered as having one object in view, and as acting upon one system.” (quoting 1 James Kent, Commentaries on American Law 433 (1826))).

24. 403 U.S. 602 (1971).

25. Id. at 612–13.

26. Id. at 612.

27. Edwards v. Aguillard, 482 U.S. 578, 586–87 (1987).

28. Id. at 595.

29. Id. at 593.

30. Forty Topics Pertaining to the General Revision of the Internal Revenue Code: Hearings before H.R Comm. on Ways and Means, 83d. Cong. 1576 (1953) (statement of Hon. Peter F. Mack, Jr.).

31. Lynch v. Donnelly, 465 U.S. 668, 680 (1987); see also Corp. of Presiding Bishop of Church of Jesus Christ of Latter-Day Saints v. Amos, 483 U.S. 327, 330 (1987) (rejecting the argument that in order for a law to comply with the Establishment Clause it must be completely unrelated to religion).

32. Amos, 483 U.S. at 337 (stating that “[f]or a law to have forbidden ‘effects’ under Lemon, it must be fair to say that the government itself has advanced religion through its own activities and influence.”).

33. See CPSC v. GTE Sylvania, Inc., 447 U.S. 102, 118 (1980) (stating that “ordinarily even the contemporaneous remarks of a single legislator who sponsors a bill are not controlling in analyzing legislative history.”).

34. See Gaylor, 919 F.3d at 427-28 citing Edwards, 482 U.S. at 586-87 (stating “[w]e will defer to a government’s sincere articulation of secular purpose, so long as the plaintiffs have not proved that articulation of purpose is a sham.”)

35. Lemon, 403 U.S. at 612.

36. See Chemerinsky, supra note 10, at 713.

37. Although other per se exemptions from § 119(a)(2) exist, they are distinguishable since they apply to government employees. See 26 U.S.C § 912; 26 U.S.C. § 134. The government is entitled to pay their employees however they see fit and any constitutional challenge would likely fail under the deferential rational basis test.

38. 483 U.S. 327 (1987).

39. See id. at 335 (stating that exempting religious organizations from Title VII was justified in order “to alleviate significant governmental interference with the ability of religious organizations to define and carry out their religious missions.”).

40. Brief for Tax Law Professors as Amici Curiae Supporting Plaintiff-Appellee at 13, Gaylor v. Mnuchin, 919 F.3d 420 (7th Cir. 2019) (Nos. 18-1277 & 18-1280), 2018 WL 3311509, at *13.

41. Lemon, 403 U.S. at 612–13.

42. Lynch v. Donnelly, 465 U.S. 668, 684 (1987).

43. See, e.g., Serbian Eastern Orthodox Diocese v. Milivojevich, 426 U.S. 696, 708 (1976) (holding civil courts cannot interfere with the rulings of church tribunals on church affairs); Lemon, 403 U.S. at 621–22 (holding that the comprehensive state surveillance necessary to ensure statutory restrictions are followed was excessive entanglement).

44. See Rev. Rul. 72-606, 1972-2 C.B. 78.

45. Lemon, 403 U.S. at 621–22.

46. 565 U.S. 171 (2012).

47. Compare Rev. Rul. 72-606, 1972-2 C.B. 78, with id. at 190–92 (inquiring into Hosanna-Tabor’s employment to determine whether she qualified as a minister).

48. See, e.g., County of Allegheny v. Am. Civ. Liberties Union Greater Pittsburgh Chapter, 492 U.S. 573, 657 (1989) (Kennedy, J., dissenting).

49. Town of Greece v. Galloway, 572 U.S. 565, 577 (2012).

50. Van Orden v. Perry, 545 U.S. 677, 691–92 (2005) (plurality opinion).

51. Galloway, 572 U.S. at 583.

52. The concerns of hostility many justices have regarding the Lemon test stems from the Court’s “religious symbol” jurisprudence. For example, in County of Allegheny v. American Civil Liberties Union, a religious symbol case, Justice Kennedy remarked that an approach which failed to consider the nation’s history and “heritage would border on latent hostility to religion, as it would require government in all its multifaceted roles to acknowledge only the secular, to the exclusion and so to the detriment of the religious.” 492 U.S. at 657 (1989) (Kennedy, J., dissenting). A relatively unknown provision within the United States Tax Code does not raise such religious hostility concerns. See also Alex J. Luchenitser and Sarah R. Goetz, A Hollow History Test: Why Establishment Clause Cases Should Not Be Decided through Comparisons with Historical Practices, 68 Catholic L. Rev. 664–65 (arguing that the limited federal practices at the time of the Founding shed little light on modern Establishment Clause controversies).