By Rudra Reddy*

In Section 10(b) of the Securities Exchange Act of 1934 makes it unlawful to “use or employ . . . any manipulative or deceptive device or contrivance” in violation of the Securities Exchange Commission’s (“SEC”) rules. The Supreme Court has recognized the right of private plaintiffs to bring claims against primary violators of § 10(b). However, only the SEC is permitted to bring claims against persons who provide “substantial assistance” to primary violators. This Contribution addresses the potential liability under Rules 10b-5(a) and (c) of a specific category of defendants who fall somewhere between primary and secondary violators—those who neither “make” nor distribute false or misleading statements themselves but ask an employee to distribute such statements to investors. Consistent with the plain text of § 10(b) and Rule 10b-5, Supreme Court precedent, and congressional intent, this Contribution argues that primary liability should not be extended to junior managers.

Congress adopted the Securities Act of 1933 and the Securities Exchange Act of 1934 in the wake of the Great Depression to “substitute a philosophy of full disclosure for the philosophy of caveat emptor” in securities trading.1 Section 10(b) of the 1934 Securities Exchange Act (“the Act”) makes it illegal to “use or employ . . . any manipulative or deceptive device or contrivance” in violation of the SEC’s rules.2 The SEC has proscribed two kinds of conduct under the Act: (1) making false or misleading statements or omissions under Rule 10b-5(b), and (2) engaging in fraudulent or deceptive schemes or practices under Rule 10b-5(a) and (c).3

Within these categories, the Supreme Court has differentiated between primary and secondary liability.4 For its part, Congress has defined primary violators as those who “directly or indirectly” engage in violative conduct.5 By way of contrast, secondary violators provide “substantial assistance” to primary violators without otherwise engaging in violative conduct themselves.6 Private plaintiffs can sue primary violators for contravening Rule 10b-5.7 Meanwhile, only the SEC can pursue secondary violators for aiding and abetting primary violators.8

This Contribution considers the liability of a category of potential defendants: junior managers taking their instructions from senior executives in the corporate chain of command to direct subordinate associates to distribute false or misleading information to investors. The liability of actors on either side of these junior managers in the corporate chain is relatively uncontested. The senior executives who make the decision to deceive investors through false or misleading statements are likely liable as primary violators under Rule 10b-5(b).9 Meanwhile, low-level associates who mail out such statements to investors under orders from the junior managers are better thought of as aiders and abettors, left to the enforcement discretion of the SEC.10

However, the potential liability of junior managers to private plaintiffs in this context is unresolved. For the reasons set out below, plain text, congressional intent, and policy considerations weigh against imposing primary liability on these potential defendants.

First, the plain text of Rules 10b-5(a) and (c) does not reach the conduct of these “junior managers” because (1) they neither make nor distribute the statements themselves, and (2) they do not identify themselves as the source of the statements.11

Rule 10b-5(a) prohibits actors from employing a “device, scheme, or artifice to defraud.”12 The definitions of the three terms in the regulatory text as determined by contemporary dictionaries help illustrate the scope of the rule itself:

Webster’s Second International Dictionary . . . defines (1) “device” as “[t]hat which is devised, or formed by design; a contrivance; an invention; project; scheme; often, a scheme to deceive; a stratagem; an artifice,” (2) “scheme” as “[a] plan or program of something to be done; an enterprise; a project; as, a business scheme[, or] [a] crafty, unethical project,” and (3) “artifice” as a “[c]rafty device; trickery; also, an artful stratagem or trick; artfulness; ingeniousness.”13

As these definitions illustrate, Rule 10b-5(a) prohibits conduct requiring evidence of a common plan or scheme to deceive.14 Further, Supreme Court precedent prior to Lorenzo had only read Rule 10b-5(a) to proscribe false or deceptive schemes or practices, not statements.15

Here, this Contribution does not address potential defendants who engage in scheming or planning to defraud investors. This Contribution does not address those junior executives who engage in the process that leads to the creation of a deceptive scheme. It is limited to the potential liability of executives who communicate orders to further a scheme already planned by a senior executive. The mere act of instructing an employee to mail out false or misleading statements to investors does not, by itself, show the scheming required by the statutory scheme. Therefore, the plain text of Rule 10b-5(a) simply does not reach the conduct of the category of defendants this Contribution is addressing.

Further, the plain text of Rule 10b-5(c) does not cover the conduct of these “junior managers” because an overly broad reading of the Rule would muddle primary and secondary liability. Specifically, Rule 10b-5(c) prohibits actors from engaging in any “act, practice, or course of business” that would work a fraud on any person.16 Referring again to dictionary definitions, an “act” is defined as “a doing” or a “thing done.”17 Also, a “practice” is defined as “action” or “deed.”18

Read too broadly, the plain text of this Rule would encompass both primary and secondary actors who violate SEC regulations. This is because every abettor of a primary violator engages in “acts” or “deeds” that would work a fraud on a third person. As an example, a mailroom clerk who mails out a misleading investment prospectus with little knowledge of its contents and under strict orders to do so from management also commits an “act” or “deed” that works a fraud on those investors. However, as the Supreme Court noted in Lorenzo v. SEC, that is exactly the kind of tangential actor who should not be subject to primary liability under Rule 10b-5.19 Thus, the broadest reading of Rule 10b-5(c) simply cannot be enforced by courts as it would render secondary liability superfluous.

Since the need to adopt a narrower construction is apparent, the Supreme Court’s precedent appears to require either (1) that an employee held themself out as the source of the statements or (2) that the fraudulent scheme could not be executed as a prerequisite to imposing primary liability without the employee’s involvement. To support the first prong, the Supreme Court in Lorenzo noted the fact that the alleged violator sent false statements to investors directly, invited them to follow up with him if they had any questions, and did so in his capacity as vice president of the company were significant factors in holding him primarily liable.20 As to the second prong, the Supreme Court has stated whether an actor was “necessary” in putting in place a deceptive scheme is another important factor in determining whether primary liability applies.21

Here, given this narrower reading, the “junior managers” cannot be primarily liable to their investors. Unlike the defendant in Lorenzo, these potential defendants do not hold themselves out as the source of the false or misleading statements. Any communications with deceptive statements sent to investors do not identify their role in putting those statements together or their role within the organization. Further, the “junior managers” do not invite plaintiffs to follow up with any questions.

Also, the involvement of these defendants in the dissemination of misleading communications is not necessary to execute the fraudulent scheme. A senior executive who wishes to mislead investors can simply choose another conduit to get false or misleading information out to the intended recipients. Further, imposing primary liability on these defendants would risk subjecting actors who acted under strict instructions from their managers to primary liability. Hence, primary liability for these defendants is not appropriate under Rules 10b-5(a) and (c).

In addition to a plain text reading, Rules 10b-5(a) and (c) do not support primary liability as a matter of congressional intent. The Second Circuit has acknowledged that maintaining a clear separation between primary and secondary liability is necessary to enforce the heightened pleading requirement for plaintiffs suing under Rule 10b-5(b).22 The Private Securities Litigation Reform Act (PSLRA) requires a complaint against a “maker” of misstatements or omissions to “specify each statement alleged to have been misleading, [and] the reason or reasons why the statement is misleading[.]”23 However, since Rules 10b-5(a) and (c) do not base liability on “making” a misstatement, actions brought under those rules do not have to satisfy the heightened pleading requirement.24 Therefore, construing liability for disseminators broadly under Rules 10b-5(a) and (c) may allow plaintiffs with misstatement claims to evade Congress’s judgment to raise their pleading burden under the PSLRA.25

Further, in the corporate context, these concerns are heightened. Under a broad reading of disseminator liability, private plaintiffs could sue everyone involved in the process of sending a false or misleading statement. They would conceivably be able to bring misstatement claims under Rule 10b-5(b) against primary violators at the top of the corporate chain and scheme liability claims under Rule 10b-5(a) and (c) against junior staff who followed orders from senior staff. Simply put, a broad reading of disseminator liability cannot draw a principled distinction between the vice president of an investment banking company and a secretary.26 Since Congress left actions against such secondary actors to the SEC, imposing primary liability on this class of defendants would defy reasoned legislative judgment.

Finally, evidence in the congressional record suggests that the possibility of allowing private claims against aiders and abettors was suggested to Congress and rejected. In his testimony before the Senate Securities Subcommittee, former chairman of the SEC Arthur Levitt criticized the Supreme Court’s holding in Central Bank and explicitly recommended allowing private claims against secondary violators.27 However, not only did Congress refuse to allow private claims against secondary violators, it raised the pleading burden for alleged “makers” of misstatements under the PSLRA28 and entrusted the SEC with actions against aiders and abettors.29 Thus, construing Rules 10b-5(a) and (c) broadly threatens to create an implied right of action that Congress rejected.30

Thus, plain text and congressional intent indicate that Rules 10b-5(a) and (c) do not impose primary liability for these “junior managers”—a result supported by the policy consideration that expansive readings of those rules would damage American securities markets without conferring significant benefits to investors.

The Supreme Court has noted that private securities actions can impose high monetary costs on companies that have to defend against them, even if they are breaking no laws or duties.31 Additionally, in the context of the liberal discovery provisions and disclosure requirements that the Federal Rules of Civil Procedure impose on defendants, the cost of defending against a securities fraud case represents an “in terrorem increment of the settlement value” relative to the realistic prospect of success in trial.32 Practically speaking, defendants in securities cases must settle nearly all cases that survive a motion to dismiss.33 Thus, courts should hesitate to add to this cauldron of securities litigation without clear congressional authorization.

Furthermore, there is evidence to suggest that the SEC has not been asleep at the wheel in its enforcement. In 2022 alone, the SEC announced 760 total enforcement actions, including 462 standalone actions.34 As a result, the SEC collected $4.2 billion in civil penalties last year.35 Also, aside from private enforcement actions, secondary violators may be liable under other statutes.36

Thus, imposing primary liability on these “junior managers” would risk encouraging vexatious litigation. Private plaintiffs would have an incentive to file suit against all persons who are involved in the circulation of deceptive statements, no matter how attenuated their involvement is in the alleged fraud. They would be able to sue primary actors for fraudulent misstatement under Rule 10b-5(b) and secondary actors under scheme liability theories under Rule 10b-5(a) and (c). This would only add to the costs companies have to pay in defending against securities litigation, without necessarily increasing the merits of the claims pursued. As the law currently stands, these potential defendants should not be held primarily liable under Rule 10b-5(a) and (c) as disseminators subject to private prosecution.

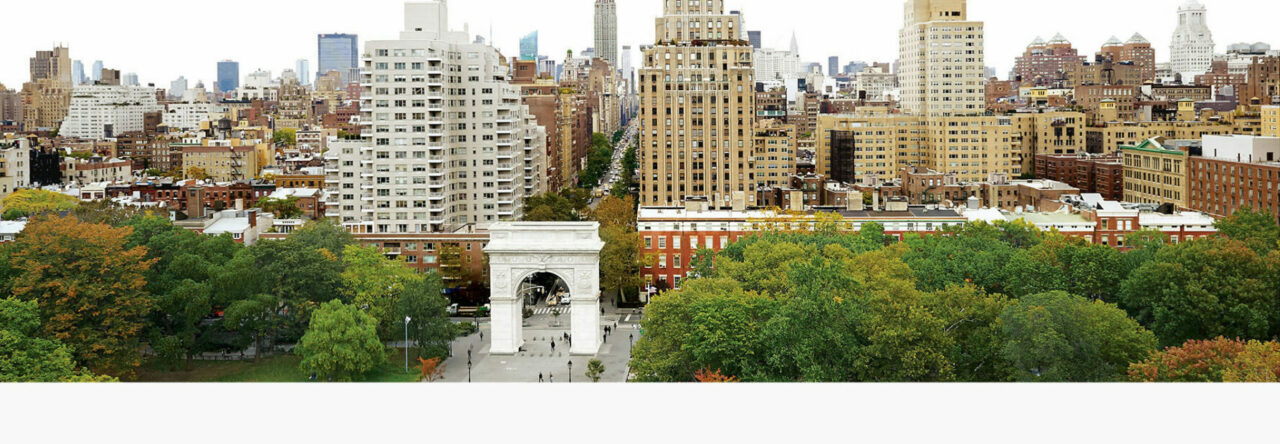

* Rudra Reddy is a J.D./MBA candidate at New York University School of Law and Leonard N. Stern School of Business. This Contribution is a commentary on the problem at the 2023 Irving R. Kaufman Memorial Securities Law Moot Court Competition, hosted by Fordham University School of Law. The question presented was whether individuals who neither “make” nor distribute false or misleading statements can be subject to primary liability as a “disseminator” under Rule 10b-5(a) and (c) for instructing an employee to distribute the statements to investors. This Contribution distills one side of the argument, and the views expressed herein do not necessarily represent the author’s views.

1.Sec. & Exch. Comm’n v. Cap. Gains Rsch. Bureau, Inc., 375 U.S. 180, 186 (1963).

2. Manipulative and deceptive devices, 15 U.S.C. § 78j(b).

3. Employment of manipulative and deceptive devices, 17 C.F.R. § 240.10b-5 (2023).

4. See, e.g., Central Bank of Denver, N.A. v. First Interstate Bank of Denver, N.A., 511 U.S. 164, 177 (1994) (finding that primary liability under the 1934 Act does not reach aiders and abettors); Stoneridge Inv. Partners, LLC v. Scientific-Atlanta, 552 U.S. 148, 166 (2008) (citations omitted) (“Secondary actors are subject to criminal penalties and civil enforcement by the SEC.”).

5. 15 U.S.C. § 78j.

6. Liability of controlling persons and persons who aid and abet violations, 15 U.S.C. § 78t(e).

7. Central Bank, 511 U.S. at 176 (concluding that aiding and abetting is not prohibited by “the text of § 10(b) itself” and therefore cannot be subject to a private 10b-5 suit).

8. Stoneridge, 552 U.S. at 166 (“Secondary actors are subject to criminal penalties and civil enforcement by the SEC[.]”); 15 U.S.C. § 78t(e).

9. See Janus Cap. Grp., Inc. v. First Derivative Traders, 564 U.S. 135, 142 (2011) (holding that a person with ultimate authority over a deceptive or misleading statement is primarily liable).

10. See Lorenzo v. Sec. & Exch. Comm’n, 139 S. Ct. 1094, 1101 (2019) (finding that liability “would typically be inappropriate” for an actor who is “tangentially involved in dissemination” like a mailroom clerk).

11. See id. (“[T]he petitioner in this case sent false statements directly to investors, invited them to follow up with questions, and did so in his capacity as vice president of an investment banking company.”).

12. Employment of manipulative and deceptive devices, 17 C.F.R. § 240.10b-5(a) (2023).

13. Aaron v. Sec. & Exch. Comm’n, 446 U.S. 680, 696 n.13 (1980) (quoting Webster’s International Dictionary 713, 2234, 157 (2d ed. 1934) [hereinafter Webster’s Second]).

14. See Lorenzo, 139 S. Ct. at 1107 (Thomas, J., dissenting) (noting that the terms in Rule 10b-5(a) require “some form of planning, designing, devising, or strategizing”).

15. See id.; Aaron, 446 U.S. at 696; United States v. Naftalin, 441 U.S. 768, 770, 778 (noting that relevant provisions encompass price rigging, short-selling scheme, matched orders, and other deceptive schemes.)

16. 17 C.F.R. § 240.10b-5(c) (2023).

17. Webster’s Second, supra note 13, at 25.

18. Id. at 1937.

19. See Lorenzo, 139 S. Ct. at 1101 (dicta) (“[O]ne can readily imagine other actors tangentially involved in dissemination—say, a mailroom clerk—for whom liability would typically be inappropriate[.]”).

20. Id.

21. See Stoneridge Inv. Partners, LLC v. Scientific-Atlanta, 552 U.S. 148, 161 (2008) (“[N]othing respondents did made it necessary or inevitable for Charter to record the transactions as it did.”).

22. Sec. & Exch. Comm’n v. Rio Tinto PLC, 41 F.4th 47, 55 (2d Cir. 2022) (“[A] widened scope of scheme liability would defeat the congressional limitation on the enforcement of secondary liability, multiply the number of defendants subject to private securities actions, and render the statutory provision for secondary liability superfluous.”).

23. Requirements for securities fraud actions, 15 U.S.C. § 78u-4(b)(1).

24. Rio Tinto, 41 F.4th at 55 (citing Menaldi v. Och-Ziff Cap. Mgmt. Grp. LLC, 164 F. Supp. 3d 568, 577 (S.D.N.Y. 2016)).

25. Id.

26. See Lorenzo, 139 S. Ct. at 1111 (Thomas, J., dissenting) (noting that broad scheme liability would treat primary and secondary actors alike even though it may be “inappropriate” to do so).

27. Concerning the Central Bank of Denver Decision: Hearing before the Subcomm. on Sec. of the Sen. Comm. on Banking, Hous., & Urb. Aff., 103d Cong. 82, 83 (1994).

28. See 15 U.S.C. § 78u-4(b)(1).

29. Liability of controlling persons and persons who aid and abet violations, 15 U.S.C. § 78t(e).

30. Rio Tinto, 41 F.4th at 55.

31. Tellabs, Inc. v. Makor Issues & Rts., Ltd., 551 U.S. 308, 313 (2007).

32. Blue Chip Stamps v. Manor Drug Stores, 421 U.S. 723, 741 (1975) (emphasis added).

33. Brief for the United States as Amicus Curiae Supporting Petitioners, Tellabs, 551 U.S. 308 at 22 (No. 06-484).

34. Press Release, Sec. & Exch. Comm’n, Commission Filed 760 Enforcement Actions and Recovered Record $6.4 Billion in Penalties and Disgorgement on Behalf of Investing Public (Nov. 15, 2022) (on file with author).

35. Id.

36. See, e.g., Civil liabilities on account of false registration statement, 15 U.S.C. § 77k (imposing private liability on accountants, underwriters, and other persons for false statements or omissions in registration statements).