by August Meny*

In Chapters 7, 13, and some Chapter 11 bankruptcies, an administrative payment under § 503(b)(9) made by a trustee would not constitute an “otherwise unavoidable transfer” under § 547(c)(4)(B), meaning that creditors can use both § 503(b)(9) and a § 547(c)(4) defense to protect their transfers. However, the unique role of debtors-in-possession in some Chapter 11 bankruptcies has led some courts to interpret § 503(b)(9) as foreclosing the § 547(c)(4) defense under (c)(4)(B) when a debtor-in-possession makes the transfer. This Contribution argues that this differential treatment of § 547(c)(4)(B) in Chapter 11 bankruptcies involving debtors-in-possession erroneously strays from the principle that debtors-in-possession should be treated the same as trustees, and that § 547(c)(4)(B) should be read to apply only to pre-petition transfers across all major forms of bankruptcy.

Under § 547(b)(4)(A) of the Bankruptcy Code, trustees may avoid preferential transfers which are made “on or within 90 days before the date of the filing of the petition.”1 That is, a trustee has the power to claw back payments made by the debtor to creditors within that pre-petition period. However, the Bankruptcy Code provides several restrictions on that avoidance power of trustees through § 547(c), among them § 547(c)(4), which protects transfers to creditors who have provided “new value” to the debtor’s benefit.2 § 547(c)(4)(B) restricts the use of this defense when the debtor made “an otherwise unavoidable transfer to or for the benefit of such creditor” on account of the new value provided.3

By way of example, consider the following scenario. A trustee wants to avoid a transfer to a creditor of $100 made in two installments by the debtor before the bankruptcy was declared so that all the creditors can be paid their fair share. The two $50 installments were made 89 days and 19 days before the bankruptcy was filed respectively. Sixty days in, the creditor provided $50 worth of wood on account of the first payment. The creditor might be able to prevent the trustee from clawing back the first $50 using § 547(c)(4) because they provided $50 worth of new value in wood after the first payment. However, since the debtor paid another $50, if the creditor seeks to protect that second transfer and the protection is deemed an “unavoidable transfer,” § 547(c)(4)(B) could make it impossible for the debtor to use § 547(c)(4) to protect the first payment. That way, instead of the creditor being able to protect $50 under § 547(c)(4) and $50 under another claim (in this hypothetical, as seen infra § 503(b)(9)) for a total defense of $100, § 547(c)(4)(B) cancels the § 547(c)(4) defense, so the creditor can only protect $50 of the $100 under the § 503(b)(9) defense. Alternatively, the creditor could also protect $50 under the § 547(c)(4) defense if they forgo the § 503(b)(9) defense. However, the result is the same either way: they must choose between one of the two defenses. The trustee can then claw back the remaining $50 for the bankruptcy estate.

Section 547(c)(4) functions primarily to incentivize otherwise nervous creditors to continue to do business with soon-to-be debtors who are fighting against bankruptcy.4 It would seem to follow, then, that the provision and its restrictions would be read to benefit the creditor. But a problematic interpretation of § 547(c)(4)(B) has emerged that could instead take rights away from the creditor. Some courts, when faced with a defense under § 547(c)(4) and an administrative payment under § 503(b)(9), are finding that the provision of the latter cancels out the former because of the § 547(c)(4)(B) restriction discussed above.5

Section 503(b)(9) allows for creditors to be paid an administrative expense for “the value of any goods received by the debtor within 20 days before” the commencement of the bankruptcy proceeding, so long as those sales happen in the ordinary course of business.6 The outstanding question for § 547(c)(4) is whether the transfer under § 503(b)(9) is “otherwise unavoidable.”7 Because administrative expenses under § 503(b)(9) are often found to be unavoidable in cases involving § 547(c)(4),8 some courts have read the text to suggest that § 503(b)(9) renders the § 547(c)(4) defense invalid by application of § 547(c)(4)(B).9 Yet there is significant evidence that suggests reading § 547(c)(4)(B) to exclude a § 503(b)(9) administrative expense would twist the bankruptcy system in unintended ways by making § 547(c)(4)(B) apply to transfers made after the petition date when it was designed primarily for pre-petition transfers.10

Although there are many reasons to suggest that § 547(c)(4)(B) should be read to only restrict the § 547(c)(4) defense to a pre-petition unavoidable transfer, this Contribution targets a justification largely underdeveloped in the federal courts.11 Chapter 5 of the Bankruptcy Code governs the relationship between “creditors, the debtors, and the estate” for all types of bankruptcy proceedings.12 Yet this conflict between a § 503(b)(9) claim and § 547(c)(4) defense only emerges in a specific subset of bankruptcies—the majority of Chapter 11 bankruptcies. Post-petition payments in all other common bankruptcy proceedings, under Chapters 7 and 13, are made by the trustee, the entity to which the debtor would relinquish the estate post-petition.13 Even some Chapter 11 bankruptcies do not involve a debtor post-petition, and although these constitute a rare subset of Chapter 11 proceedings, they still help inform how Chapter 11 overall should function.14 Thus, post-petition payments that would not block the § 547(c)(4) defense in Chapter 7, 13, and some Chapter 11 bankruptcies would block it in other Chapter 11 bankruptcies. Only some Chapter 11 bankruptcies involve this perplexing situation, suggesting that it was not considered in the design of the bankruptcy code. Given that the Bankruptcy Code imbues trustees and debtors-in-possession with similar and overlapping powers, § 503(b)(9) should not be read with § 547(c)(4)(B) to deprive a Chapter 11 debtor-in-possession of powers exercised without such a limitation by Chapter 7, 13, and 11 trustees in identical circumstances.

It is important to understand why Chapter 11 bankruptcies involve the debtor post-petition in the first place to understand how much of an outlier the situation involving § 547(c)(4)(B) and § 503(b)(9) really is. There are three main types of bankruptcies in the United States: Chapters 7, 11, and 13.15 Chapter 7, a “liquidation” bankruptcy, simply involves the sale of all a debtor’s assets to pay off as much of their debts as possible in an equitable fashion.16 In Chapter 7 bankruptcies, a trustee, appointed on the petition date, controls that distribution.17 A Chapter 13, or “wage earners,” bankruptcy allows the debtor to keep certain forms of property (most importantly, their homes) while creating a repayment plan for their debts and liquidating other assets.18 And, similar to Chapter 7, a trustee is appointed to control distribution after the petition date.19 Thus, any transfers that trigger § 547(c)(4)(B) will have been made pre-petition in Chapter 7 and 13 bankruptcies, since the trustee, and not the debtor, is making such transfers post-petition.

Chapter 11, however, is called a “reorganization” bankruptcy, and generally functions in a way that facilitates the continued operation of a business, although individuals can also file for Chapter 11 bankruptcies.20 Unlike Chapters 7 and 13, trustees do not control the disbursement of assets, although they will have significant oversight over a business’s continued operation.21 The fiduciary role is instead filled by the debtor, who takes on the moniker of the “debtor-in-possession.”22 Under 11 U.S.C. § 1107(a), the debtor-in-possession is imbued with “all the rights . . . and powers, and shall perform all the functions and duties . . . of a trustee serving in a case under this chapter [11.,” with certain exceptions mentioned in the statute.23 But the duties and powers of a trustee under Chapter 11 significantly overlap with those of Chapter 7, as many of them are derivative of that chapter.24 This similarity evinces an intentional overlap between the duties of the debtor-in-possession in Chapter 11 and the duties of trustees in Chapter 7, which also can occur with trustees in Chapter 13 bankruptcies.25 To withdraw a power that any other trustee could reasonably exercise, including the power to make a § 503(b)(9) transfer without risking the cancellation of a § 547(c)(4) defense, would therefore go against the scheme envisioned for Chapter 11 as a whole.

Critics may argue that Chapter 11 is its own beast and that the norms of Chapters 7 and 13 should not be imposed on it. Yet even within Chapter 11 of the Code, parallel problems could arise when a trustee replaces the debtor-in-possession. Section 1104 allows for the appointment of a trustee “for cause” or “if such appointment is in the interests of creditors, any equity security holders, and other interests of the estate. . . .”26 In effect, this replaces the debtor-in-possession with a trustee if the debtor-in-possession cannot be trusted to act as a proper fiduciary.27 Any trustee appointed under this provision would be able to both pay out an administrative expense under § 503(b)(9) and avoid a transfer under § 547(c)(4); the (c)(4)(B) exception would not apply because it only applies to transfers made by debtors. Thus, even in Chapter 11 bankruptcies, there are certain ways of executing these post-petition transfers that clearly do not violate § 547(c)(4)(B). If a trustee can make the same payment under Chapter 11 without triggering § 547(c)(4)(B), and the debtor-in-possession is supposed to exercise the same powers as a trustee in that Chapter, consistency with the statutory scheme would permit the debtor-in-possession to make that payment without triggering § 547(c)(4)(B) restrictions as well. Furthermore, § 1104 acts as a fail-safe to prevent any abusive doubling up of § 503(b)(9) and § 547(c)(4)—if such actions are not in the interest of the creditors, § 1104 allows them to request the removal of the debtor-in-possession.28

Only the Third Circuit in Friedman’s Liquidating Trust has come close to grappling with this line of reasoning. In doing so, the court makes only a cursory analysis that the existence of the term “debtor-in-possession” in the bankruptcy code does not imply that debtors are solely pre-petition entities.29 The court’s analysis does not grapple at all with the contentions made herein that § 547(c)(4)(B) would never apply to the same situation in Chapters 7 and 13 bankruptcies, as well as Chapter 11 bankruptcies with a trustee. Friedman’s points to post-petition duties for debtors in § 329 and § 521, and assumes that the mere existence of such a duty, although minimal and largely administrative in nature, disproves the contention that § 547(c)(4)(B) was not designed with post-petition transfers in mind.30 But the duties listed in § 329 and § 521 provide no real insight on the context in which § 547(c)(4)(B) is supposed to apply—they merely say that a debtor could be referenced in a pre-petition context in the bankruptcy code.31

Because of Friedman’s, it may seem to the bankruptcy advocate that any argument based on the debtor/debtor-in-possession distinction for determining the temporality of the § 547(c)(4)(B) restriction on otherwise unavoidable transfers would be frowned upon in appellate courts. But my hope is that by demonstrating how § 547(c)(4)(B) is usually inoperative post-petition because of the involvement of trustees, and how Chapter 11 bankruptcies with debtors-in-possession disrupt this norm, advocates will be able to make a stronger case that payments under § 503(b)(9) should not trigger § 547(c)(4)(B) in this subset of cases. The fiduciary relationship shared by trustees and debtors-in-possession and linked explicitly in the provisions of the bankruptcy code suggests that the courts should embrace harmony in the treatment of situations involving § 547(c)(4)(B) and § 503(b)(9). By emphasizing how drastically different the treatment of debtors-in-possession is from other trustees, advocates can show how strange it would be to block § 503(b)(9) payments with § 547(c)(4)(B) in this one aberrant instance.

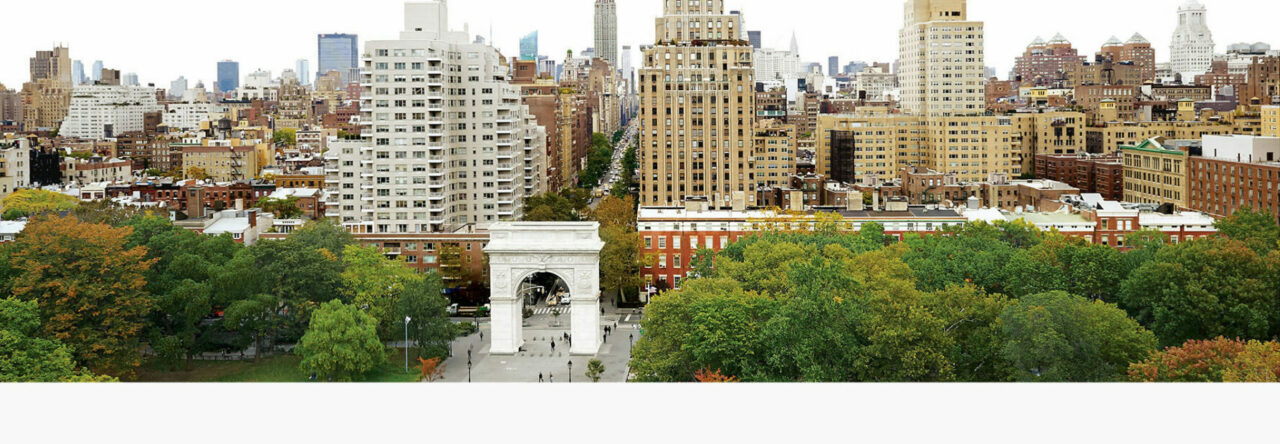

* August Meny is a J.D. Candidate (2023) at New York University School of Law. This Contribution arose from the problem at the 2022 Duberstein Bankruptcy Competition hosted by St. John’s Law School. The question presented was “whether a seller of goods may reduce its preference exposure according to 11 U.S.C. § 547(c)(4) by the new value conveyed to the debtor, after the debtor paid for the goods in full as an administrative expense under 11 U.S.C. § 503(b)(9).” This Contribution considers a portion of the argument assigned to the author in the competition and the views expressed herein do not necessarily reflect the views of the author.

1. 11 U.S.C. § 547(b)(4)(A).

2. Id. § 547(c).

3. Id. § 547(c)(4)(B).

4. See Phoenix Rest. Grp. v. Ajilon Pro. Staffing LLC, 317 B.R. 491, 497 (Bankr. M.D. Tenn. 2004) (“At its heart, the preference power in § 547 levels the playing field for creditors that do business with a debtor during the slide into bankruptcy.”).

5. See Beaulieu Liquidating Tr. v. Fabric Sources, Inc. (In re Beaulieu Grp., LLC), 616 B.R. 857, 878 (Bankr. N.D. Ga. 2020) (concluding that when a “debtor has established reserves to pay [the § 503(b)(9)] administrative claims in full,” the reserves constitute an “otherwise unavoidable transfer” by the debtor, and “the new value represented by the § 503(b)(9) claim cannot be used to offset the creditor’s preference liability” with a § 547(c)(4) defense).

6. 11 U.S.C. § 503(b)(9).

7. 11 U.S.C. § 547(c)(4)(B).

8. See, e.g., Circuit City Stores, Inc. v. Mitsubishi Dig. Elecs. Am., Inc. (In re Circuit City Stores, Inc.), 2010 Bankr. LEXIS 4398 at *26 (Bankr. E.D. Va. 2010) (“Thus, under the holding of JKJ, the Transfer for the Benefit of Mitsubishi on account of its 503(b)(9) Claim . . . is an otherwise unavoidable transfer.”).

9. See In re Beaulieu Grp., LLC, 616 B.R. at 878.

10. For a selection of arguments developed in favor of § 547(c)(4)(B) applying only to post-petition transfers, see Friedman’s Liquidating Trust v. Roth Staffing Cos. LP (In re Friedman’s Inc.), 738 F.3d 547, 555 (3d. Cir. 2013). Ironically, Friedman’s rejects an argument derived from the debtor/debtor-in-possession distinction, discussed infra in notes 29–31 and accompanying text.

11. See In re Beaulieu Grp., LLC, 616 B.R. at 878.

12. 11 U.S.C. Chapter 5 (quoting title of the chapter).

13. Chapter 7 – Bankruptcy Basics, United States Courts (Dec. 17, 2022), https://www.uscourts.gov/services-forms/bankruptcy/bankruptcy-basics/chapter-7-bankruptcy-basics.

14. See 11 U.S.C. § 1104 (discussing the procedures for appointing a trustee in a Chapter 11 bankruptcy).

15. See supra note 13. Other forms of bankruptcy exist, but they tend to be highly specialized. See, e.g., Chapter 12 – Bankruptcy Basics, United States Courts (Dec. 17, 2022), https://www.uscourts.gov/services-forms/bankruptcy/bankruptcy-basics/chapter-12-bankruptcy-basics (a form of bankruptcy for farmers and fishermen.).

16. See supra note 13.

17. Id.

18. Chapter 13 – Bankruptcy Basics, United States Courts (Dec. 17, 2022), https://www.uscourts.gov/services-forms/bankruptcy/bankruptcy-basics/chapter-13-bankruptcy-basics.

19. Id.

20. Chapter 11 – Bankruptcy Basics, United States Courts (Dec. 17, 2022), https://www.uscourts.gov/services-forms/bankruptcy/bankruptcy-basics/chapter-11-bankruptcy-basics.

21. Id.

22. Id.

23. 11 U.S.C. § 1107(a).

24. Id. § 1106(a)(1) (“A trustee shall perform the duties of the trustee, as specified in [certain] paragraphs . . . of section 704(a).”).

25. Id. § 1302(b) (“The trustee shall perform the duties specified in [certain sections of 704(a)].”).

26. Id. §§ 1104(a)(1)–(2).

27. White, Clifford J. III & Theus, Walter W. Jr., Taking the Mystery Out of the Chapter 11 Trustee Appointment Process, Executive Office for U.S. Trustees at 1 (2014), https://www.justice.gov/sites/default/files/ust/legacy/2014/05/01/abi_201405.pdf.

28. Id. at 4.

29. Friedman’s Liquidating Trust, 738 F.3d at 555. As discussed supra note 9, Friedman’s ultimately supports the proposition that § 547(c)(4)(B) is not triggered by § 503(b)(9) but does so on other grounds.

30. Id. at 555; see, e.g., 11 U.S.C. § 521 (“a statement disclosing any reasonably anticipated increase in income or expenditures over the 12-month period following the date of the filing of the petition.”). The quoted section is one of the relevant post-petition duties of a debtor included therein, but it is emblematic of the more disclosure-oriented duties that § 521 entails.

31. See Friedman’s Liquidating Trust, 738 F.3d at 555. As stated in Friedman’s, § 329 only references a context in which the debtor is mentioned post-petition. Section 529 does describe certain post-petition duties, but as described supra note 30, those duties are more oriented towards disclosure, and they have little relation to determining the avoidability of a transfer.